“One, Big Beautiful Bill” Passed By House Of Representatives, Now Awaits Senate Vote

on May 22, 2025

Budget Bill Fulfills Many Of Trump’s Campaign Promises

“In the coming weeks and months, we will pass the largest tax cuts in American history, and that will include no tax on tips, no tax on Social Security, no tax on overtime,” President Donald Trump said to a crowd at his April 29 rally in Michigan. “It’s called the One, Big, Beautiful Bill.”

One, Big, Beautiful Bill is the name that Trump and Republicans have given to the budget bill which is due by mid-July to avoid a government shutdown.

More than an ordinary budget bill though, Trump is pushing this as an important part of his presidential mandate.

While majorities in the House of Representatives and the Senate are thin, the Republican majorities in the year before the 2026 midterms are seen as essential to carrying out Trump’s agenda.

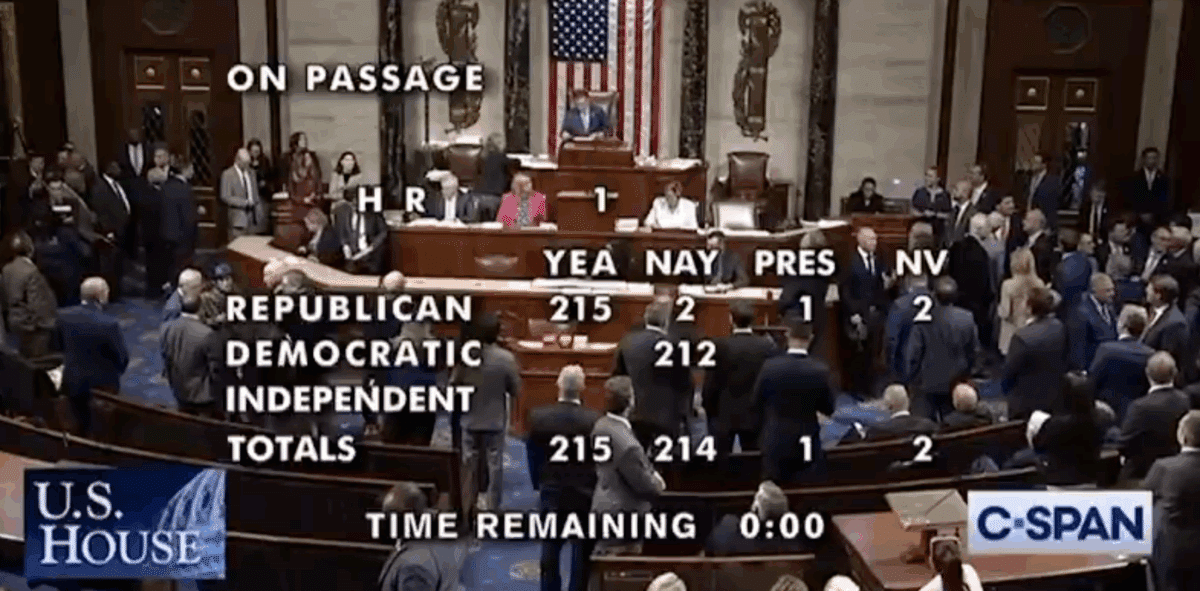

With July 4, Independence Day, set as a loose deadline for passing the One, Big, Beautiful Bill, the House Republicans approved the bill in a 215-214 vote on Thursday, May 22.

Every Democrat member of the House voted against the bill.

Two Republicans — Rep. Warren Davidson, R-OH, and Rep. Thomas Massie, R-KY — voted against it as well. An additional Republican — Rep. Andy Harris, R-MD — voted “present,” and two others did not vote.

Overcoming this hurdle, the bill now heads to the Senate for approval.

What’s In the Bill?

At the onset of the bill is the desire to make Trump’s tax cuts from his first term permanent, but there are some new additions to the discourse which have attracted further attention.

Trump’s promise to end tax on tips, tax on overtime, and tax on Social Security is only met by the budget bill on two of those three categories.

The bill fulfills the popular no tax on tips and no tax on overtime promises, but only reduces taxes paid by seniors on Social Security.

While there is only a reduction in taxes for seniors on Social Security, the bill outlines that seniors, aged 65 and over (making under $75,000 if filing single, or less than $150,000 if filing jointly), will be eligible for an additional $4,000 deduction.

There are also provisions for families with young children.

Beyond renewing the Trump child credit rate of $2,000 per dependent child, it will add an additional $500, bringing the total child credit to $2,500.

Then there’s the aptly named MAGA accounts, with MAGA being an acronym for Money Accounts for Growth and Advancement. Overseen by the Treasury, the bill allows for any child under 8 to have an account set up, allowing them “to receive contributions from parents, relatives, and other taxable entities as well as non-profit and government entities facilitated by the Treasury Department.”

The MAGA accounts can only be used by the child once they reach 18, with 50% of funds being required to go to “higher education, training programs, small business loans, or firsttime home purchases.” By 25, the full MAGA account balance may be accessed, but only used for specific purposes. At age 30, the full balance may be accessed for any use.

Parents of children born between January 1, 2024, and December 31, 2028, can submit their child’s Social Security Number to create an account and receive $1,000 for the child’s account from the federal government.

The Debt Ceiling

This bill has faced some backlash, with Senator Rand Paul (R-KY) criticizing the bill for, in its final section, raising the debt ceiling by $4 trillion.

Prior to the passing of this bill, the debt ceiling is over $36 trillion.

“[Raising the debt ceiling] is enough for me not to support the bill, even though I support large segments of the bill,” Paul said in an interview with The National News Desk on May 15. “My fear is that really true cutting is not going to happen.”

To read the full One, Big, Beautiful Bill, visit budget.house.gov/download/one-big-beautiful-bill-act_-full-bill-text.