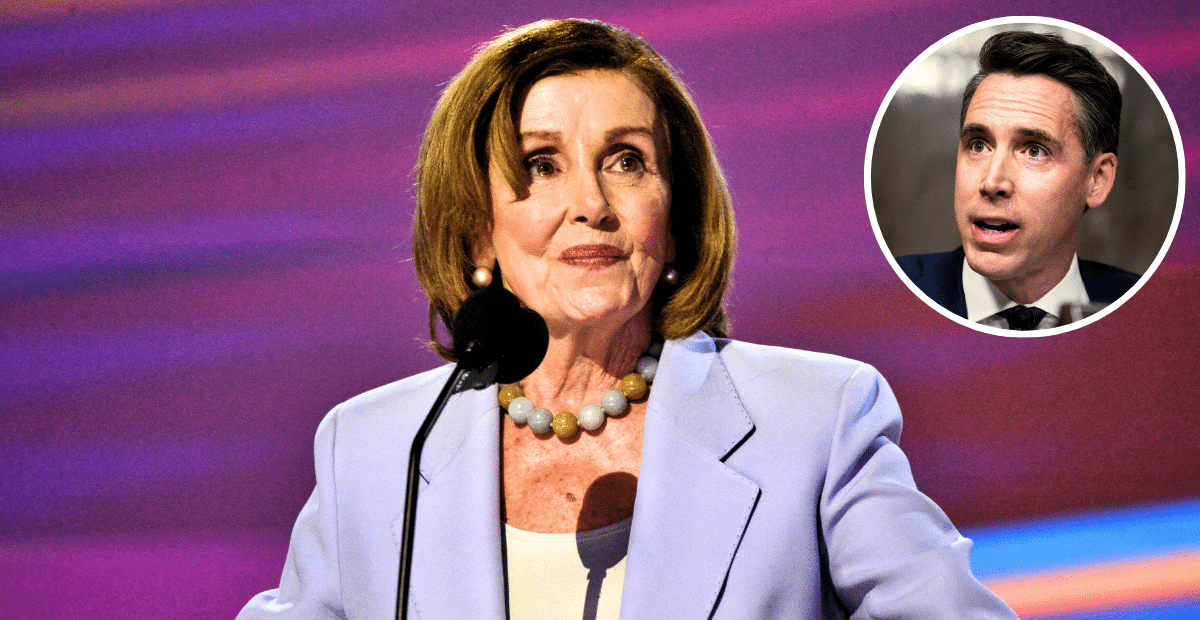

Senator Reintroduces “PELOSI Act” In Effort To Prevent Congress Members From Trading Stocks

on Apr 29, 2025

The Bill Aims To Prevent Insider Trading In Congress

Should members of the United States Congress be able to trade and hold individual stocks?

Through a newly reintroduced bill, Sen. Josh Hawley, R-MO, is saying, “No.”

This comes as President Donald Trump said in an April 25 interview with Time Magazine that he would sign such a bill into law.

In a press release, Hawley said:

“Members of Congress should be fighting for the people they were elected to serve — not day trading at the expense of their constituents. Americans have seen politician after politician turn a profit using information not available to the general public. It’s time we ban all members of Congress from trading and holding stocks and restore Americans’ trust in our nation’s legislative body.”

The PELOSI Act

Initially introduced by Hawley on January 24, 2023, during the Biden administration, the bill is known as the PELOSI Act, which is an acronym for Preventing Elected Leaders from Owning Securities and Investments.

The bill’s acronym is a pointed reference to Rep. Nancy Pelosi, D-CA, who has reportedly benefited — with her husband, Paul Pelosi, the owner of a venture-capital investment firm — in stock market trading as a U.S. representative.

When asked by Time Magazine if he would back a ban on congressional stock trading, Trump replied, “Well, I watched Nancy Pelosi get rich through insider information, and I would be OK with it. If they send that to me, I would do it.”

Pressed further about whether he would sign a bill on the matter, Trump simply said, “Absolutely.”

If approved, Hawley’s bill would prevent members of Congress and their spouses from trading and holding individual stocks.

The Bill’s Language

Reintroduced on Monday, April 28, Hawley’s PELOSI Act states, “A Member of Congress, or any spouse of a Member of Congress, may not, during the term of service of the Member of Congress, hold, purchase, or sell any covered financial instrument.”

Upon approval, sitting members of Congress would have 180 days to comply with this law, and new members would have 180 days to comply at the start of their term.

Penalties include a member of Congress or their spouse having to “disgorge to the Treasury of the United States any profit from a transaction or holding involving a covered financial instrument that is conducted in violation of this section.”

There would also be a civil fine, which would be determined by the applicable supervising ethics committee.

Further, there is a public accountability measure, as each member of Congress would “submit to the applicable supervising ethics committee a written certification that the Member of Congress has achieved compliance with the requirements of this subchapter.”

The supervising ethics committee will then publish the results to “a publicly available website.”

Holdings excluded from prohibition in this bill include:

- A diversified mutual fund;

- A diversified exchange-traded fund;

- A United States Treasury bill, note, or bond; or

- Compensation from the primary occupation of a spouse or dependent child of a member of Congress.

Read the full bill here: https://www.hawley.senate.gov/wp-content/uploads/2025/04/Hawley-PELOSI-Act.pdf

On April 28, the PELOSI Act was read twice and then referred to the Committee on Homeland Security and Governmental Affairs.